Hyundai invests in robotics

Hyundai Motor Group is reducing its reliance on making cars and delving further into the world of robotics after buying a controlling stake in US-based robot maker Boston Dynamics.

The South Korean carmaker says the purchase will help it expand automation in its vehicle factories and design autonomous cars, drones and robots, as it seeks to become a broader mobility service provider.

Euisun Chung, chairman, says robotics will account for 20 per cent of Hyundai’s future business, car making 50 per cent and urban air transport the remaining 30 per cent.

Hyundai is taking the controlling stake from SoftBank Group Corp in a deal that values Boston Dynamics at US$1.1 billion (NZ$1.55b).

Under the agreement, Hyundai will secure a 60 per cent stake in Boston Dynamics, Chung will own 20 per cent and Softbank will retain 20 per cent.

The move looks set to accelerate the robot maker’s path to commercialisation. Boston Dynamics, which was spun out from the Massachusetts Institute of Technology in 1992, was bought by Google in 2013 and sold to SoftBank in 2017.

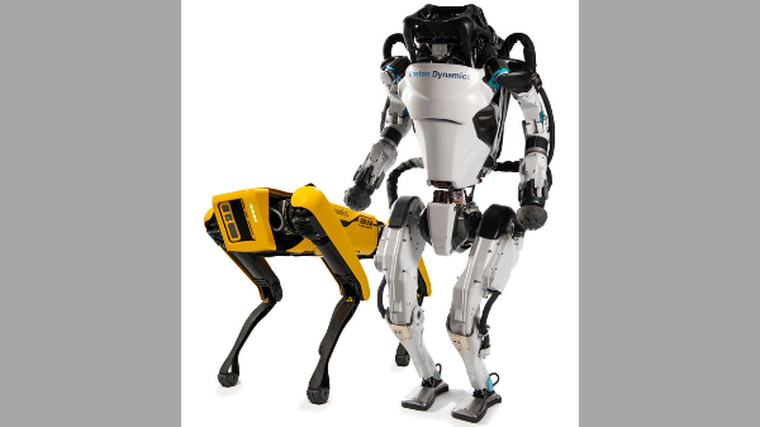

Spot, a dog-like robot that can climb stairs, is among the company’s products. Ford leased two of those creations in July 2020 as part of a pilot programme.

Hyundai says it plans to invest in logistics robots to enhance efficiency and establish logistics automation, as well as service robots, which have broad usage potential beyond commercial use in areas such as public security and safety.

It also hopes the deal with Boston Dynamics will help eventually help it expand its presence into the humanoid robot market with the “aim of developing humanoid robots for sophisticated services such as caregiving for patients at hospitals”.

The transaction, subject to regulatory approvals, is expected to close by June 2021.