Training scheme on ‘fiscal cliff’

Apprenticeship Boost is among the programmes identified as being on a “funding cliff” by the Finance Minister in her mini budget.

It is one of a number of projects that Nicola Willis says the previous government left with money in place for “only a limited period even while there was a clear public expectation it would continue”.

While the iReX Interislander ferry scheme was among the headline-grabbers in mainstream media, the Treasury has advised Willis of 21 instances of “fiscal cliffs” where costs over the forecast period are estimated to be more than, or close to, $50 million.

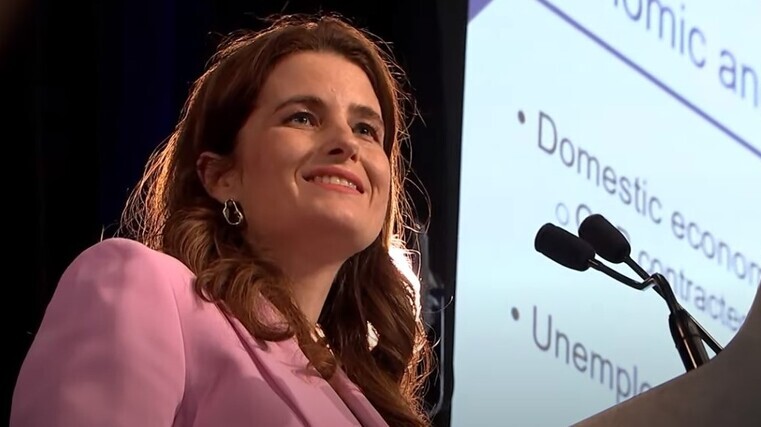

“I am advised that fully continuing funding for all these programmes would come with an indicative fiscal cost of $7.2 billion over the forecast period,” says Willis, pictured.

“I have asked ministers to identify other fiscal cliffs in their portfolios that may fall short of the Treasury’s $50m materiality threshold.

“Cost blowouts in major infrastructure projects abound. The iReX Interislander ferry project is one example. I have also been advised the transport investment programme that the previous government signalled a commitment to deliver had an estimated total cost of $288b while only $85b had been appropriated to meet these costs.

“As part of the Budget 2024 process, I have asked ministers to identify major capital projects at risk of cost blowouts, delay or failure so the government can work carefully to manage them.”

In addition to Apprentice Boost, which is backed by industry organisations such as the Motor Trade Association, the list of 21 “fiscal cliffs” disclosed to Willis by the Treasury include tertiary tuition and training funding baseline pressure, and international climate financing.

Big-ticket schemes

The mini budget on December 20 included $2.61b of savings delivered by stopping work on a series of programmes, such as Let’s Get Wellington Moving, the fair-pay agreement regime and industry transformation plans.

“In some cases, decisions have also removed fiscal risks from the government books, such as the potential $15b liability for Auckland Light Rail, up to $16b associated with building a pumped hydro scheme at Lake Onslow, and the risk of further funding being required in future to balance the cost of clean car discount rebates with the level of fee revenue received from high-emissions vehicles,” says Willis.

“Our decisions ensure that $2.047b of forecast cash proceeds from the emissions trading scheme [ETS] can be used as a ‘climate dividend’ to support income-tax reduction, including by closing the Government Investment in Decarbonising Industry Fund, which has been subsidising already-profitable businesses to reduce emissions.

“The coalition has further work under way to put New Zealand on a firmer financial footing, including… full cost-recovery for immigration visa processing.”

Overall, Willis unveiled $7.47b in cuts and savings in the mini budget. They include $2.8b from tax and benefit changes and $500 million in savings started by the previous government. On top of these, Willis has committed to annual cuts of $1.5b from public service “savings”, which add up to $6b over a four-year period.

Income tax ‘progress’

“The government is progressing work to deliver meaningful income tax reduction in next year’s Budget,” says Willis. “This includes considering design and implementation advice for the delivery of our proposed Family Boost childcare tax rebate, and for delivering income relief to workers and their families.

“Work is continuing to uphold the commitment in the Act-National coalition agreement to consider the concepts of Act’s income-tax policy as a pathway to delivering National’s promised tax relief, subject to no earner being worse off than they would have been under National’s plan.

“The advice we have received so far gives the government confidence that we can responsibly deliver the tax relief New Zealanders deserve.”

Looking to the future

The Treasury’s half-year economic and fiscal update was released with the mini budget. Forecasts are gloomy with a weaker economy since the last update in September seeing the tax take fall by $1.6b over the forecast period, while expenses have grown mainly due to more borrowing and higher interest costs.

The Treasury predicts GDP growth to average 1.5 per cent over two years, compared to 3.2 per cent in the year to June 2023, and a surplus of $140m compared with the $2.07b forecasted in September.

Inflation is expected to hit 4.1 per cent by June 2024 before falling. Unemployment of 4.5 per cent is anticipated for the current year compared to 3.6 per cent to June 2023. It’s expected to peak at 5.2 per cent in the June 2025 year before decreasing.