Size of vehicle loans grows

New figures show vehicle loan arrears have dropped slightly to 5.5 per cent of active credit accounts, according to Centrix.

The credit bureau’s latest monthly report states the May figure is also unchanged from the same time last year.

Meanwhile, demand for new vehicle loans in the three months to the end of May increased 2.7 per cent when compared with the same period a year ago.

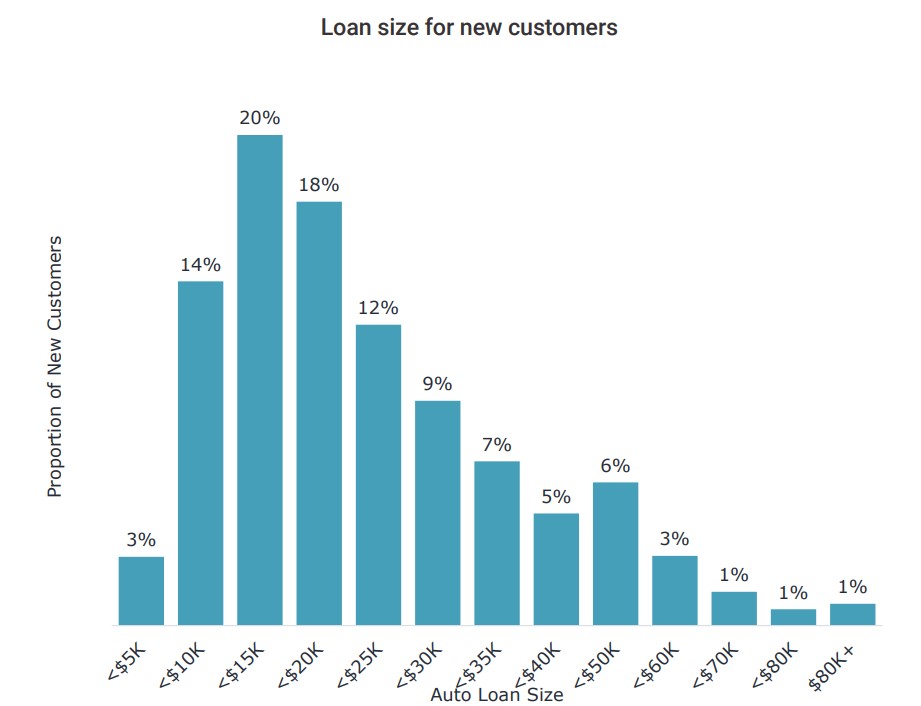

Centrix adds the average size of a new automotive loan is about $22,700, reflecting a continuing upward trend over recent years, and more than 20 per cent of new borrowers take out loans between $10,000 and $15,000.

The report says the rate of automotive loans 30 or more days past due is currently 3.1 per cent, which is lower than the 3.4 per cent recorded in February but higher than 2.4 per cent year-on-year.

Other statistics show the average age of consumers taking out a loan to buy a vehicle is around 42, a figure that has remained stable, with 19 per cent of borrowers under 30 and 26 per cent aged 50 or older.

The average credit score among these borrowers is 667, below the national average of 744.

Credit indicators

Centrix’s June report says there are signs the economy is beginning to head in the right direction, “albeit with a few bumps along the way”.

Its latest data shows customer arrears continued to show signs of stability in May, with the number of individuals behind on payments climbing slightly to 485,000 – up from 483,000 in April – but down one per cent year-on-year.

Among those, 180,000 consumers were more than 30 days past due, with 81,000 more than 90 days in arrears.

Residential mortgage arrears declined to 1.44 per cent, with 21,900 accounts past due, and credit card arrears improved to four per cent, the lowest since September 2022.

In contrast, buy now, pay later arrears rose to nine per cent, slightly higher than a year ago.