Turners dismisses takeover suggestion

Turners Automotive Group has ruled out any plans for attempting to take over 2 Cheap Cars, saying it would not be the right move for the business.

A shareholder at Turners’ annual meeting on August 21 asked if the company was likely to attempt such a move for its rival.

Grant Baker, chairman, replied: “No, is the short answer. We are interested in M&A but you’ve got to find the right thing.

“We’re growing 14 per cent year on year, we’re growing quite fast and it’s just got to be the right thing. We’re always on the lookout but have never found the right thing.

“[2 Cheap Cars] are operating in a different segment than us, we’re in that $10,000 and up [bracket].

“I’m not sure what their parameters are but it could be $10,000 and down, as their name would suggest, so it’s not a market we want to play in.”

The message to shareholders repeats comments made by Baker at the 2022 annual meeting when he said there was no advantage to making a move for 2 Cheap Cars, which was then known as NZ Automotive Investments.

Resolutions pass

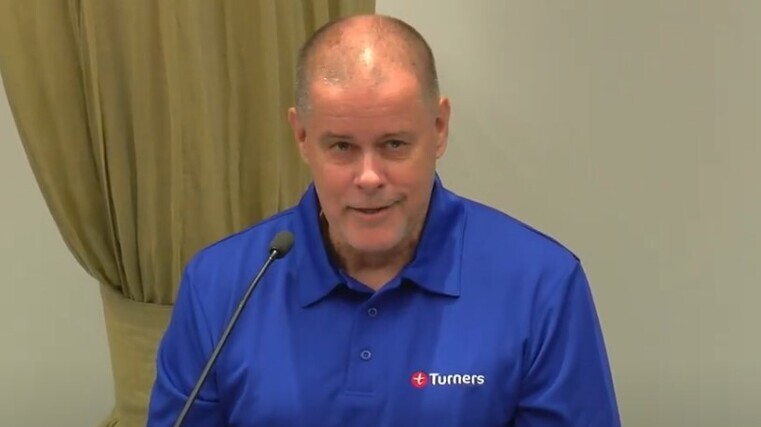

Baker, pictured, was re-elected as a director of Turners at this week’s board meeting and chief executive Todd Hunter was elected as a director after shareholders cast their votes.

Earlier in the meeting held in Auckland, Baker gave a presentation highlighting that the 2025 financial year delivered a fifth record result in a row for Turners despite operating in a challenging macro environment.

“Three out of four of our businesses are materially ahead of the previous year and the other business had its second-best year ever,” he said.

“Our team has worked incredibly hard to ensure that some of the toughest economic conditions we’ve faced didn’t derail our growth strategy. Auto retail remained our largest division and the pressure it faced in the first half was no small matter.

“In what were arguably conditions worse than the GFC we proved that demand for used vehicles is resilient and though margins were squeezed for a period our ability to proactively improve those margins during the recovery in H2 was pleasing.

“With auto retail firmly back in growth mode we enter FY26 with a strong momentum across all segments and we believe we’re on track to reach our FY28 targets earlier than expected.”

‘Cookie-cutter approach’

Hunter also addressed attendees, telling them a highlight for Turners this year has been the opening of three new branches in Christchurch.

After sharing footage of the three sites, dominated by large blue buildings, he explained the company is now focusing on a number of “live offers” to develop new branches elsewhere across the country.

“There’s a good pipeline building so there are plenty of opportunities ahead of us and we’re working hard on that,” he said.

“We’re almost trying to bring a new-car kind of feel to used cars [with our branches].

“It’s very identifiable and this iterative process we’ve had around branches has sped up our delivery in what we know works and getting the right configuration between operations and office and admin space and how to configure the processing part into the retailing part of those sites.

“We have a very kind of cookie-cutter approach to this now.”

He added about $36 million was invested into the Christchurch branches, which are all owned by Turners.

“I think pretty quickly we’ll be looking for a fourth based on the way things are tracking so far and we’re definitely seeing upside from the three over the one [branch] so it’s been a great move for us.”

Hunter said the used-car market was proving its resilience and while people are spending less on cars, “there are still lots of cars changing hands in New Zealand”.

“We’ve seen a lift in activity but with the continued pressure on household budgets we’re seeing demand for those lower-value cars at the expense of the higher-value cars be very strong and our expectation is that will revert as the economy improves.”

The mix between consignment cars and owned cars for the automotive retail division had also changed in the first half of this year.

Hunter explained lease volumes are down and a number of corporate customers have extended leases rather than taking on new commitments, which has meant fewer cars coming back to the business.

“I would consider that a timing issue, those cars will come back they just haven’t come back in the first half,” he added.

“But [the] team has done a super job making up for that by buying more cars locally so we’re still running ahead in terms of unit sales on last year.

“We’re still expecting the second half to deliver strong vehicle margin and volumes as the economy improves and overall demand improves.”