Tariffs turmoil rumbles on

It has been a whirlwind week in the world of tariffs with US President Donald Trump chucking a U-turn and pausing increased duty rates for goods imported into the US from many countries for 90 days.

The idea behind stalling the higher levies appears to be to allow room to negotiate lower trade barriers, even as he hiked new tariffs on Chinese goods to 125 per cent in what appeared to be a fit of pique.

Trump’s move on April 9 followed market turmoil that wiped out trillions of dollars in stock values. It was the latest course reversal in his hastily rolled out tariff agenda, sowing confusion about its objectives.

His 25 per cent tariff on imported cars, steel and aluminium remain in place. It comes into effect on automotive parts on May 3.

The net effect of Trump’s action this week is that many goods from 57 trading partners will be subject to a 10 per cent US import tariff for 90 days. These markets include the European Union, Japan and South Korea.

The “baseline” 10 per cent rates that took effect on April 5 for most other countries, including Brazil, New Zealand, Australia and the UK, will remain in place for that period.

After several tit-for-tat tariff escalations, including China’s 84 per cent tariff on American goods announced by Beijing this week, Trump again hit back with higher duties, raising the total new duties imposed on that country since he took office in January to 125 per cent.

These came in addition to tariffs he had already imposed on many Chinese goods during his first term as president.

Impact on Japan

While Trump has cut tariffs for most countries for now, the 25 per cent tax on imported cars remains in place.

It’s a concern for Japan, which sells 20 per cent of vehicles it makes to the US. Now its government is scrambling to try to strike a deal with the Americans.

Trump’s decision on April 9 on the 90-day halt just 13 hours after the tariffs went into effect was welcomed by Japan and its markets.

The 225-issue Nikkei stock average rose by 9.13 per cent and 2,894.97 points. It was its second-biggest point increase and the seventh-biggest percentage jump. Toyota went up 7.61 per cent, Sony 13.52 per cent and Mitsubishi UFJ Financial 9.56 per cent on the back of it.

In a social media post, Trump said he made the U-turn because so many countries approached the US seeking trade negotiations and didn’t retaliate. Japan, India, South Korea, the UK, Vietnam and Taiwan expressed a willingness to talk, with some offering the possibility of zero per cent tariffs on American imports.

A dramatic bond rout in the US might also have been a factor. The yield on 10-year Treasury holdings rose from about 3.9 to 4.5 per cent this week as the tariffs were implemented. Billions in wealth were wiped out as US bond prices moved inversely to yields, government financing became more expensive, and balance sheets of banks and corporations holding debt might have come under stress.

Tokyo is strongly urging Washington to reconsider the new tariffs – on vehicles, steel and aluminium products – that haven’t been suspended for nearly three months.

Japan’s newly appointed top tariff negotiator Ryosei Akazawa is reportedly planning to visit Washington next week.

Japan’s automotive exports to the US in 2024 made up 28.3 per cent of its total exports to America.

Timeline of events

January 20: US President Donald Trump sworn in.

February 7: Japan’s Prime Minister Shigeru Ishiba meets Trump at the White House.

February 10: Trump announces 25 per cent tariffs on steel and aluminium imports.

March 12: 25 per cent steel and aluminium tariffs go into effect.

March 26: Trump announces 25 per cent tariffs on automotives and automotive part imports.

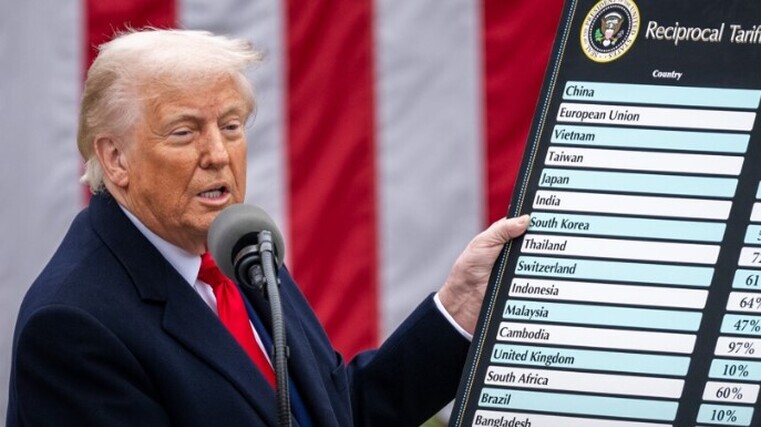

April 2: Trump announces “reciprocal tariffs” on imports from almost every country, with a 10 per cent automotive baseline tariff on all imports and separate higher rates for dozens of countries, setting the rate on Japan at 24 per cent.

April 3: 25 per cent automotive tariff comes into effect.

April 4: Ishiba calls the tariff measures a “national crisis” for Japan.

April 5: Baseline 10 per cent tariffs on all goods into US start.

April 7: Ishiba and Trump hold 25-minute phone call to discuss tariffs, and the US appoints Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent to lead talks with Japan.

April 8: Japan appoints Ryosei Akazawa as its top tariff negotiator.

April 9: Higher rate “reciprocal tariffs,” including 24 per cent on Japan, go into effect. Japanese Finance Minister Katsunobu Kato rules out using the country’s US Treasury holdings as a bargaining tool.

April 9: Trump orders 90-day pause of higher rate “reciprocal tariff” with other tariffs remaining in place.