Recession threat lurks over Japan

Japan’s economy is in danger of a recession after taking another battering from a sales-tax hike in the last quarter and the coronavirus outbreak hitting activity at the start of 2020.

Japan’s GDP shrank at an annualised pace of 6.3 per cent from the previous quarter in the three months through December, the biggest slide since a previous tax increase in 2014, according to a preliminary estimate by the Cabinet Office.

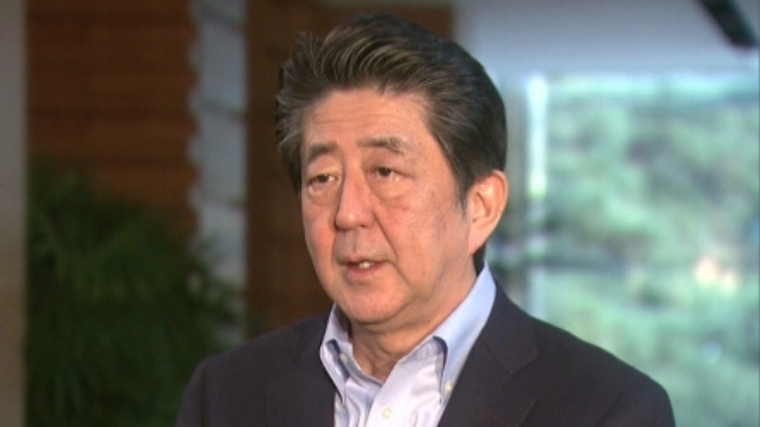

The tax hike, weak global demand and typhoon disruption have all been setbacks for the Japanese economy. The result also raises the possibility Prime Minister Shinzo Abe, pictured, may have to consider extra spending to support growth, little more than two months after his most recent stimulus package.

Abe’s administration and the Bank of Japan had expected a smaller effect from the recent tax hike compared with the experience in 2014, when it buckled the economy by more than seven per cent.

The latest data shows private consumption fell by an annualised 11 per cent in the quarter, as households cut their purchases of cars, cosmetics and domestic appliances. In 2014 the hit was 18 per cent.

Businesses have also scaled back investment by 14 per cent as they wait for signs of a recovery from the tax shock before committing to further spending.

The coronavirus outbreak may also increase caution in boardrooms, especially after Abe told parliament the government will closely monitor the economic effect of the sales tax and the virus.

Korean carmakers losing edge in China

Korean businesses, including carmakers, are also facing tougher times and have seen their share of trade in the world’s fastest-growing Chinese market fall in recent times.

The Federation of Korean Industries, which represents the nation’s large businesses, has analysed market share changes in the top four countries – South Korea, Japan, the US and Germany – in China’s overall import market between 2010 and 2019. It shows Korea has continued to fall from a peak of 10.4 per cent in 2015 to 8.5 per cent in 2019.

The nation’s slice of the automotive and electronics sectors has dropped on the back of sluggish sales. The share of domestic car brands fell from nine per cent in 2014 to 4.8 per cent in 2019.

Recent research also reveals Hyundai Motor Company is one of only eight businesses to have been ranked among Korea’s top 50 listed companies in revenue for 35 consecutive years.

Seventy per cent of the country’s largest companies have lost their ranks or changed ownership between 1984 and 2018, according to the Sustainable Growth Institute.

Since 1984, eight companies have been listed in Korea’s top 50 without changing ownership, including Hyundai, whose sales rose more than 60 times to 43.1 trillion won (NZ$56.6 billion) during the period.