Plug-in cars lose market share

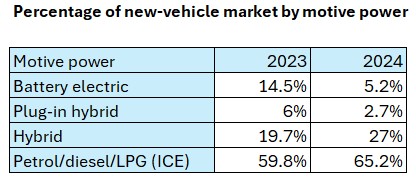

The market share of new battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) tumbled last year to less than half of what those categories achieved in 2023.

Over the same period, the portion of new-vehicle sales that were hybrids or internal combustion engine (ICE) models, those powered by petrol, diesel or LPG, increased.

Annual figures from the Motor Industry Association (MIA) show the 6,748 BEVs sold in 2024 accounted for 5.2 per cent of the market, compared with 21,611 units and 14.5 per cent in the year prior.

PHEV numbers came in at 3,484 and 2.7 per cent, which was down from 9,005 and six per cent.

Hybrids claimed 27 per cent of last year’s market on the back of 34,736 registrations, which was up from 29,319 and 19.7 per cent in 2023.

Meanwhile, the number of ICE vehicles sold slipped from 89,038 to 83,860 last year but their market share still rose from 59.8 per cent to 65.1 per cent.

A further breakdown of the latest statistics shows the same trends in the light passenger sector, where the share of BEVs fell from 19 per cent to 7.3 per cent as registrations tumbled from 21,026 to 6,362.

The market share for PHEVs slid from 8.1 per cent to 3.9 per cent on the back of sales falling from 8,985 to 3,423.

In contrast, hybrid sales rose from 29.319 to 31,209, giving them a share of 25.5 per cent and 35.7 per cent in the past two years respectively.

The number of new light passenger ICE vehicles that were sold in 2024 came in at 46,441. This was down from 51,136 in the year prior but the category’s market share increased from 46.3 per cent to 53.1 per cent.

Tesla’s Model Y, pictured, retained its spot as the top-selling BEV last year with 826 sales, which was down from 3,936 in 2023.

The Mitsubishi Eclipse Cross was the leading PHEV on 1,195 units, compared with 2,777 in the year prior, and Toyota’s RAV4 was first on the hybrids’ ladder with 10,457 units, up from 6,001.

Hybrids on the up

As for light commercials, hybrids were the big movers year-on-year after recording 3,527 sales in 2024 compared with zero in 2023. This gave them a market share of 10.5 per cent last year.

This accounted for most of the reduction in market share for ICE models, which fell from 98.4 per cent in 2023 to 88.8 per cent last year. Sales figures for this category dropped over the same period from 30,106 to 29,948.

As for BEVs, these went from taking out 1.6 per cent of the market to 0.5 per cent as sales slipped from 476 to 179.

Light commercial PHEVs recorded a rise in registrations from 20 to 61, which delivered market shares of 0.1 per cent and 0.2 per cent respectively.

The figures come as overall new-vehicle sales fell by 13.5 per cent in 2024 after totalling 128,828, compared with 148,973 in the year before.

Aimee Wiley, MIA’s chief executive, has warned navigating tougher clean car standard targets introduced for importers from January 1, 2025, while supporting the transition to lower-emissions vehicles will be the industry’s main challenge in 2025.