Motor insurance set for growth

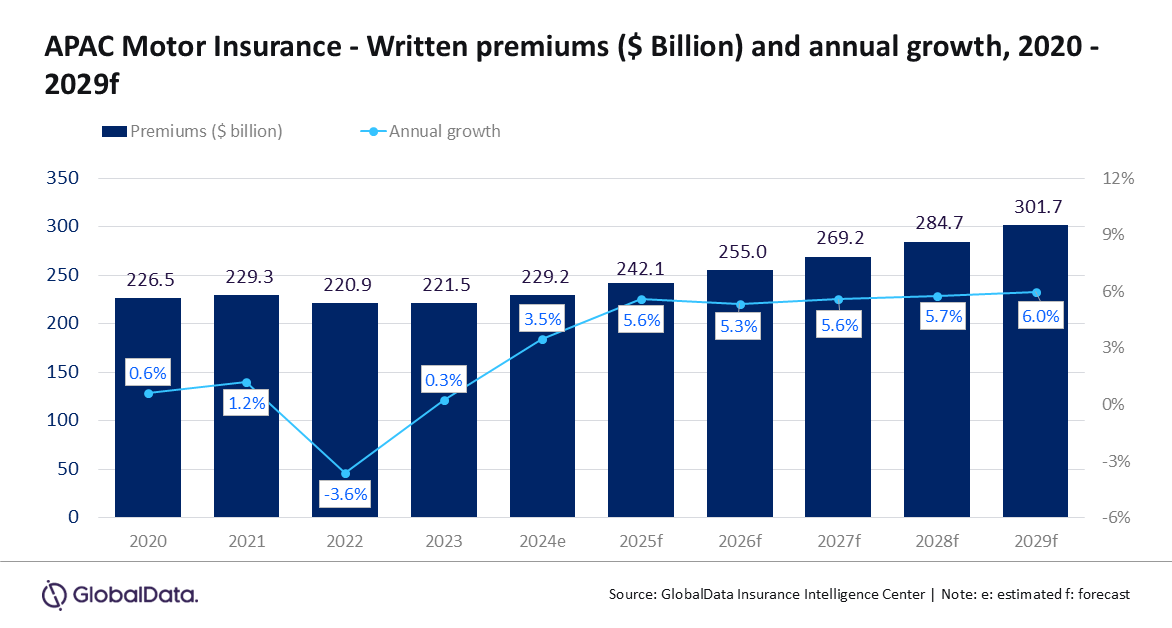

The motor insurance industry in the Asia-Pacific (Apac) region is tipped to grow over the coming years from an estimated $229.2 billion in written premiums in 2024 to $301.7b in 2029.

GlobalData, a data and analytics company, is predicting the sector will record a compound annual growth rate of 5.6 per cent during that period.

Its Global Motor Insurance Market report says the increase in activity this year will be driven by sales of motor vehicles including EVs, government subsidies and carbon dioxide reduction policies, regulatory changes, increasing motor insurance tariffs, and technological advancements.

Swarup Kumar Sahoo, senior insurance analyst at GlobalData, adds: “The Apac motor insurance market is witnessing a transformation, driven by the rise of EVs and regulatory changes.

“The region’s economic growth and demographic shifts are also playing a crucial role in shaping the market dynamics.

“For instance, the surge in vehicle sales post-Covid-19 has increased motor policy sales. Additionally, the increasing adoption of AI [artificial intelligence] and digitalisation in the insurance industry is enhancing service quality and operational efficiency, paving the way for future growth.”

GlobalData notes insurers are developing new policies to cover EVs, which come with a new set of risks, as sales of low and zero-emissions models increased significantly in 2023-24 and further growth is anticipated in 2025 and beyond.

The strategic move by vehicle manufacturers to acquire insurance companies will also contribute to the insurance industry’s growth.

In May 2024, BYD, an electric carmaker, received regulatory approval for its new motor liability insurance offering after acquiring an insurance company in China.

Sahoo adds the adoption of AI and digitalisation is helping to reshape the motor insurance landscape in the Apac region.

“Insurers are leveraging vast amounts of data to develop risk curves and pricing models for new-energy vehicles, enhancing their ability to offer competitive and tailored products,” he explains.

“However, the market remains tightly regulated, with constraints on premium increases posing challenges for insurers.

“Despite these hurdles, the focus on underwriting rigour and moderate rate increases is expected to sustain profitability and drive growth in the coming years.”

The report notes pay-as-you-drive motor policies are becoming increasingly popular in the markets such as South Korea, Singapore, Malaysia and India.

As the major benefit of such policies is lower premium rates based on good driving behaviour, distance travelled and driving patterns, its wider adoption and popularity will offset premium hikes in the short term, impacting the industry’s performance.

“The increasing adoption of EVs, pay-as-you-go policies, regulatory advancements, and technological innovations are set to redefine the market landscape,” says Sahoo.

“As countries like Indonesia plan to mandate motor third-party liability insurance and Malaysia aims for a significant EV market share by 2030, the motor insurance market in Apac is poised for substantial growth.

“Insurers must continue to adapt to these changes, leveraging technology and strategic partnerships to capitalise on emerging opportunities and ensure sustained success.”