Japanese focus on microchips

An important initiative in Japan is focusing on power semi-conductors as the war in Ukraine drives oil and gas prices through the roof.

Japan’s New Energy and Industrial Technology Development Organisation (NEDO) is co-ordinating a project aimed at reducing the energy loss of power management devices by 50 per cent while reducing the cost of mass-producing silicon carbide power semi-conductors to the same level as standard silicon-based chips by 2030. It also aims to develop more advanced gallium nitride devices.

This should lead to cheaper and more efficient electric vehicles (EVs), renewable energy, factory automation, computers and telecom equipment, data centres, air conditioning, lighting, consumer electronic, aerospace and defence systems.

The Japanese government will spend about ¥30.5 billion – or around NZ$382 million – on the project. Private companies involved are investing much more.

Shindengen and Sanken are two Japanese companies that specialise in power semi-conductors. They supply and control electricity used to run motors, charge batteries and so on by converting electric power from AC to DC and adjusting voltages to appropriate levels.

What is silicon carbide?

Silicon carbide (SiC) is a compound consisting of silicon and carbon. Compared with silicon, SiC semi-conductors offer greater energy efficiency and reliability. Their advantages include resistance to higher voltages, tolerance of temperature ranges and vibration, and longer device lifetimes.

The unit cost of a typical SiC semi-conductor is still two to three times that of one made of silicon, but the functional gains are already driving rapid growth in demand. Gallium nitride is considerably more expensive and more difficult to work with.

NEDO’s power device consortium includes three semi-conductor makers – Rohm, Toshiba and Denso – and four makers of materials and equipment used in their production.

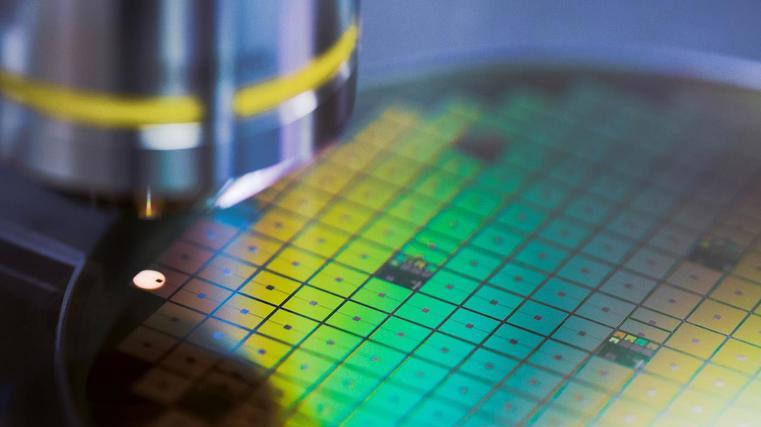

Rohm is Japan’s top producer of SiC power semi-conductors and, through its German subsidiary SiCrystal, the SiC wafers on which they are fabricated. It has been working on the technology for more than 20 years. It now has more than 10 per cent of the global market for SiC power semi-conductors and 15-20 per cent of the SiC wafer, pictured, market.

Rohm recently opened a new factory in Japan large enough to increase its SiC power semi-conductor production by five times over the next five years. In the NEDO project, Rohm will concentrate on industrial equipment.

The electronic devices division of Toshiba, one of Japan’s large industrial conglomerates, makes power semi-conductors for automotive, industrial and consumer applications. Toshiba will concentrate on trains, offshore wind power generators and data centres.

According to Nikkei Asia, Toshiba plans to increase production of SiC semi-conductors by more than three times by 2024 and 10 times by 2026.

Denso, one of the world’s top makers of automotive parts, is affiliated with Toyota. It designs and fabricates power semi-conductors, their sensors and integrated circuits (ICs) for engine electronic control units (ECUs) and other vehicle applications.

In addition to battery-powered EVs, Toyota plans to use SiC semi-conductors in its Mirai hydrogen fuel-cell vehicles.

Other Japanese companies that make power semi-conductors, but are not members of the consortium, include Mitsubishi Electric, a leading manufacturer of factory automation, automotive and power-generation equipment,

Renesas, one of the world’s top makers of automotive semi-conductors, and Fuji Electric, which makes electric power and industrial components and equipment.

The materials and equipment makers in the consortium are working on developing low-cost SiC wafers and semi-conductors, and their use in EVs and other “next-generation green power” applications. They are Showa Denko, Central Glass, Mipox and Oxide.

Listing up all these companies demonstrates the complexity of the supply chain. Led by Rohm, Japanese companies now have roughly 20 per cent of the SiC power semi-conductor market. The NEDO project targets 40 per cent by 2030.

It won’t be an easy goal to reach. The largest companies in the industry are Wolfspeed of the US, which has more than 60 per cent of the market for SiC wafers, Germany’s Infineon, which appears to have more than 30 per cent of the market for SiC power semi-conductors, STMicroelectronics, a French-Italian company headquartered in Switzerland, and US-based Onsemi.

Like the Japanese, all of them are expanding production and making significant investments to improve the technology.

Asian markets

Chinese semi-conductor makers, supported by national policies aimed at reducing power consumption and carbon emissions, are also developing capabilities in SiC units.

Three prominent examples are HHGrace, produces power semi-conductors and other products for automotive, industrial, lighting and other applications, WeEn and CanSemi. CanSemi is a semi-conductor contract manufacturer that makers them for applications including automotive electronics and telecommunications.

China is also producing SiC for use as power semi-conductor substrates. This is key to eliminating dependence on foreign supplies that might be targeted by American sanctions.

Last June, the Chinese press reported the launch ceremony of the country’s first SiC vertically integrated industrial chain took place in Changsha High-tech Industrial Park in Hunan Province.

The article notes that SiC power semi-conductors can be used in numerous applications, such as equipment including 5G, server-power supplies, solar power and other clean-energy systems, smart power grids, EVs and railways.

South Korea and Taiwan are also likely to establish a meaningful presence in the industry.

French market research and consulting firm Yole Developpement has forecast global demand for SiC power semi-conductors to increase by about four times to $4.5 billion by 2026 – driven by demand for greater energy efficiency and lower carbon emissions.

[This is an edited article by Scott Foster, an analyst with LightStream Research, Tokyo, which appeared in MENAFN – Asia Times. Click here for the full version]