Electric car wars in the US

Rivian has raised another US$350 million to support its electric truck and SUV commercialisation from multinational Cox Automotive.

The deal sets up a strategic relationship between the 10-year-old start-up that’s about to reach the market and an established company with experience managing the buying and selling of vehicles.

“We are building a Rivian ownership experience that matches the care and consideration that go into our vehicles,” say founder RJ Scaringe. “Cox Automotive’s global footprint, service and logistics capabilities, and retail technology platform make it a great partner.”

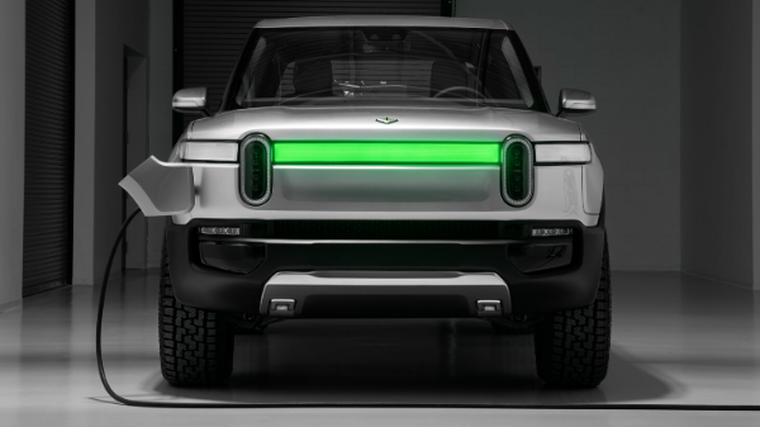

Like Tesla, Rivian started from scratch designing its own electric sports car, but it shifted to producing “adventure vehicles” instead. Rivian’s R1T ute, pictured, and the R1S SUV are set to be launched by the end of 2020 with battery range of up to 640km and a price point below US$90,000 – or about NZ$140,000.

They will sport a quad-motor architecture – one digitally controlled motor per wheel – and a bespoke data platform, battery-management system and autonomous driving controls.

US automotive sales has attracted muscular investment from prominent industrial backers. Rivian entered 2019 with US$500m raised. Then Amazon led a US$700m round in February and Ford delivered US$500m in April. That puts the total raised at US$2.05 billion.

Each of these investors has a strategic interest in an electric-truck company. Amazon’s immense logistics operation could benefit from more fuel-efficient trucking. Ford owes much of its success to its famous ute line, but is just getting around to releasing electric versions of its cars.

Cox adds a new set of strategic capabilities centred around the logistics of car sales. Tesla chose to build its own sales infrastructure, taking responsibility for a network of physical stores and delivering cars to customers. Rivian could use its relationship with Cox to tap into existing sales channels.

The company is fine-tuning its vehicle engineering near Detroit to tap into the industrial resources and supply chains there. It develops its software and autonomous driving systems in San Jose, and builds battery packs in Southern California.