Clean-car changes ‘successful’

Waka Kotahi says the June 1 changes to the clean car standard (CCS) “successfully went live” and are being used by importers to pay off charges and transfer credits.

“It was a complex technology build that took many months and we could not have done it without you,” says David Strong, programme director for low-emissions vehicles (LEVs) at the transport agency, in an email newsletter.

“We’re grateful to those who generously shared their time and expertise to test our systems and provide feedback on our approach. We’ve always aimed to make it easy for you to use the system, so thank you for making it easier for us to build something that works for you.

“We’re already seeing some great results. Around 45 per cent of PAYG [pay as you go] importers have cleared their pending charges, many using CO2 credits to offset charges. We’ve seen tens of thousands of credits being transferred with importers telling us the AML [anti-money laundering] verification process has been straightforward.”

Strong adds it has been a “great example” of government and industry working together, and he would like to acknowledge the Imported Motor Vehicle Industry Association, Motor Industry Association and Motor Trade Association “for the trusted and collaborative relationship”.

Credit transfers under the CCS are an option for importers who don’t have enough credits to offset their charges or have more than they need and want to sell to other importers.

While credit transfers take place in the CCS system, any payment for credits and terms of the trade must be managed between the two trading parties – Waka Kotahi has no visibility of, or responsibility for, the financial agreement or monetary transactions.

The AML process

Importers need to be AML checked before being able to use the CCS’ credit-transfer function, which is a requirement under the Anti-Money Laundering and Countering Financing of Terrorism Act 2009.

To get verified it’s necessary to get in touch with the CCS team online through CO2 accounts, phone 0800-141-801 or email CCSImporter@nzta.govt.nz.

Waka Kotahi will then arrange for an AML provider to get in touch. It will require you to provide information that confirms your name, date of birth and postal address. In the case of companies or trusts, the directors, shareholders, trustees and non-discretionary trust beneficiaries may also need to provide information.

See the agency’s website for more information on AML verification.

It’s also publishing a register of CO2 account holders available for credit trading.

Waka Kotahi has produced a guide and video on how to make CCS payments and use credits to offset charges in a training hub.

If importers haven’t settled pending charges by June 21 and there are credits on their accounts, the agency will automatically use those credits to offset charges. If there are still charges owing after this, importers be required to make payment straight away.

Changes to feebates

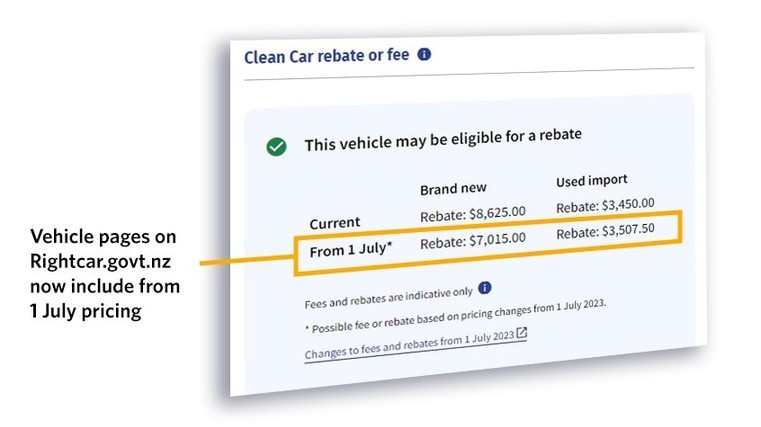

Current fee and rebate pricing under the clean car discount (CCD) will change from July 1 when planned adjustments to the scheme take effect.

Buyers who register a vehicle for the first time from that date and are eligible for a rebate, or need to pay a fee, will be impacted by the price changes.

Vehicle pages on Rightcar.govt.nz have been updated to show rebate and fee prices from next month. This information appears below current pricing, as pictured above.

There’s also a new getting ready for July 1 webpage for dealers, which summarises where to find fee and rebate pricing information. The page includes a summary about vehicle emissions and energy economy labels.

Also check out the CCD changes webpage. It includes graphs with pre and post-July 1 pricing, and downloadable rebate and fee price lists.