‘Affordability and availability’ key

New Zealand’s used-imports industry has already done the “heavy lifting” by bringing in fewer vehicles with internal combustion engines (ICE) and more petrol hybrids.

That’s the view of Matt Battle, general manager of Moana Blue. And when it comes to future targets for the clean car standard (CCS), what type of vehicles can be sourced for the local market will come down to affordability and availability.

Battle was one of four speakers at an industry forum his company hosted in Auckland on February 9. At the event, attended by about 50 people, he noted the used-imports mix into New Zealand had “notably” changed between 2018 and 2022.

For example, hybrids climbed from 4.8 to 30.2 per cent over the five-year period, while the combined total for battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) peaked at five per cent in 2022.

Used imports with ICEs have nosedived from 92.7 to 64.8 per cent of the overall total from 2018-22, while Japan accounts for 94-plus per cent of the used vehicles crossing our border.

Battle said: “Our industry has already transitioned to cleaner cars – where they are affordable and available.” And those two words – affordable and available – with the CCS moving forward are key because as a right-hand-drive market, we are only importing low-emissions vehicles (LEVs) from Japan and the UK.

“There is low availability of EVs and PHEVs from Japan – and we are already punching above our weight from there,” warned Battle. “And the situation for us from the UK will hardly get any better for many years.

“Eighty-one per cent of all on-target LEVs registered from 2021-22 were Japanese hybrids. Hybrids are our only source of CCS credits, and less than 60 ex-UK EVs and PHEVs were registered here last year.”

He stressed the used-imports industry probably couldn’t change the mix of the fleet much more than it already had – the used EV and PHEV five per cent hadn’t been “for the lack of trying”, while the drop in ICE vehicles was “significant”.

“Sales of new EVs in Japan are low compared to petrol hybrids because that market is so focused on hybrids,” explained Battle. “The UK isn’t much better and has been lagging behind Japan for EVs since 2020. Those cars aren’t available as they will not be affordable to us for many years.

“Used hybrids really are our only source of LEVs and the pressure is on to keep them coming through. We need to ensure the [clean car] legislation doesn’t cut through our ability to bring in hybrids when they are no longer affordable [because of the CCS]. That would stagnate our fleet.

“There is no magic bullet to secure EVs and PHEVs when the CCS takes a sudden change of direction in 2026/27. The CCS will become a significant impediment and force prices up. We need to ensure hybrids remain affordable.”

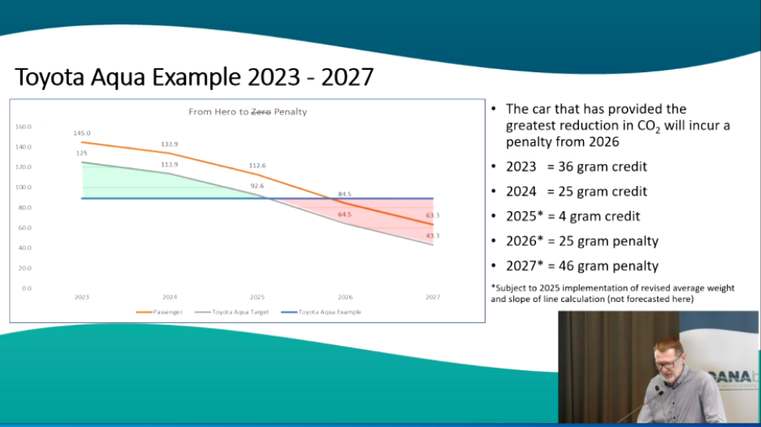

Battle said that CCS targets get more aggressive moving forward. He cited the Toyota Aqua as an example, which has an assumed emissions rating of 89 grams of CO2 per kilometre under the WLTP-3 testing protocol.

Its CCS target starts at 125gCO2 in 2023 before decreasing to 113.9g, 92.6g, 64.5g and 44.3g over the following four years – subject to the implementation of a revised weight average planned for 2025.

That compares to a starting point of 145g for passenger vehicles this year, which decreases to 133.9g, 112.6g, 84.5g and 63.3g over the same timescale out to 2027.

It’s a case of “hero to zero” or rather “penalty” with Battle emphasising the model that has given New Zealand its greatest CO2 reduction will incur a CCS penalty from 2026 (as shown in the graphic above).

Under the current policy settings of the CCS, the Aqua will attract CO2 credits of 36g, 25g and 4g in 2023, 2024 and 2025 respectively before getting pinged with charges of 25g in 2026 and 46g in 2027. Those figures are again subject to a revised weight average being planned in two years’ time.

Managing credits

Battle said it was important that vehicle importers and dealers manage the credits in their CO2 accounts set up for the CCS.

He added credits expired three full years after the year they were issued in, with credits issued in grams and not actual dollar amounts. “Without a significant change in our import mix, 2023 will have the greatest surplus of credits.”

The rates for businesses holding pay-as-you CO2 accounts are set at $18 per gram this and next year, rising to $27 per gram from 2026-28.

“Over time, penalties will get greater and credits smaller,” said Battle. “Credits can build up from today. As time moves through, targets reduce and the ability to maintain profits shrinks.

“As credits last three years from their year of issue, those you receive now go through until December 31, 2026. If you can retain credits and manage them through your business, you can bring them into play as targets get more stringent.”

Battle suggested importers and dealers rein in their credit management in the immediate future. This is because they will be unable to do anything with accrued CO2 credits until June and they need to look well into the future to remain competitive.

When it comes to paying the government for penalties accrued or trading of credits, the industry “has a holiday until June and credits will be critical to business. Come June, someone will be in the market buying CO2 credits”.

As for the CCS in overall terms, Battle described it as “the worst piece of legislation to have ever gone through” that affects the car industry because it’s so complicated. And the bottom line is, “when it comes to availability, the market is not there. We have got to be unified and push through this”.