UDC hails lending momentum

Executives at UDC Finance are feeling positive about the upcoming year after the company posted a net profit after tax of $21.7 million for the final three months of 2020.

Following the sale of the company to Shinsei Bank, the balance date for UDC was changed from September 30 to December 31 to more closely align to the financial year of its new owner.

Other highlights from the three-month period to the end of 2020 included revenue of $42.1m and total lending of $421m.

UDC reports a strong rebound in lending activity during the last quarter of the year as the post-Covid recovery continued. It also wrote back $780,000 of impairment charges that are no longer forecast to be required.

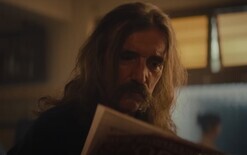

Wayne Percival, pictured, chief executive, says the coronavirus pandemic made 2020 an uncertain year but UDC had a “strong period to December”.

“This result reflects our focus on supporting customers, credit quality, prudent cost management as well as the resilience many of the industries we lend to showed throughout the year,” he explains.

“UDC has good momentum going into the 2021 financial year and will continue to focus on our core business of lending for motor vehicles, plant and machinery.

“Business confidence and other indicators of economic activity are looking positive for this year. However, the Covid-19 pandemic is still having an impact on global supply chains, across most of the industries we are involved in.”