Storm clouds over Shanghai show

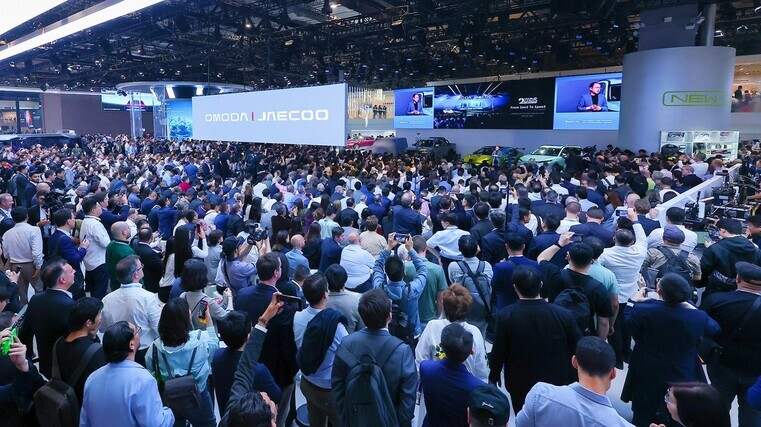

About 70 marques are exhibiting some 100 new or refreshed models at Shanghai Auto Show, which runs until May 2, with a major emphasis on electric vehicles and hybrids.

While the likes of big Chinese players such as Geely and BYD, feature strongly at the event, which kicked off on April 23, overseas brands aren’t missing out on the action as global market competition intensifies.

The show comes amidst a consumer price war in China, which has been dragging on for some years, and there’s controversy surrounding driving features with the Chinese government there getting tough on marketing claims by cracking down on terms such as “autonomous” and “smart”.

This comes in the wake of a fatal accident on March 29 involving a Xiaomi SU7 on the Dezhou-Shangrao Highway, Anhui province.

Initial information showed the car was in “navigate on autopilot” mode before the crash. It was travelling at 116kph when the system issued a risk warning of obstacles ahead.

The driver took over and tried to slow it down, but it collided with a cement pole at 97kph. Local police said the vehicle then caught fire and its key hadn’t unlocked the door.

Government scrutiny since then has resulted in Chinese carmakers reviewing their PR spiels, slamming the brakes on the likes of “automated driving”. Instead has come emphasis on motorists displaying on-road caution.

Driver-assistance systems have essentially become a tool for companies amid China’s crowded market, especially when it comes to EVs.

In February, regulators there banned carmakers from installing over-the-air updates to such software without government approval.

As a result, Tesla halted a limited-time free trial of its “full self-driving” software there. Despite its name, the system isn’t fully autonomous or what’s known in the sector as having level-four ability. Its name was changed to “intelligent assisted driving” shortly afterwards.

Chinese regulators are also tightening standards for EV batteries in a bid to reduce the risks of fires and explosions.

Meanwhile, sales in China’s “new energy vehicle” sector, which covers fully electric, plug in and petrol hybrids gasoline-electric hybrids, are surging – not only in the domestic market, but across overseas jurisdictions.

Electrified vehicles now account for more than half of all new-car sales in China. About a dozen new models making their debuts at Shanghai Auto Show are electric crossovers priced to compete directly with Tesla’s Model Y.

Tesla has steadily lost market share in China. In 2020, it peaked at 15 per cent of the country’s BEV sales to nine per cent in 2025’s first quarter. The decline has been exacerbated by chief executive Elon Musk’s shenanigans at the White House.

Felipe Munoz, global analyst at Jato Dynamics, says: “In addition to Musk’s increasingly active role in politics and increased competition in the EV market, the brand is phasing out the existing Model Y – its best-selling vehicle – in anticipation of the introduction of a new refreshed version.

“Brands often experience a drop in sales before they return to normal levels once the updated model becomes widely available. Brands like Tesla, which have a relatively limited model line-up, are particularly vulnerable to registration declines when undertaking a model changeover.”

The show in Shanghai also comes on the backdrop of Ford suspending shipments of several flagship models to China because of challenges linked to the US-China trade conflict and increased retaliatory tariffs on American-made cars.

The company says the current trade climate has disrupted export plans, prompting it to scale back shipments from America to China. Affected models include the F-150 Raptor, Mustang, Bronco SUV and Lincoln Navigator.

That said, the blue oval will continue sending US-manufactured engines and transmissions to China. And the Lincoln Nautilus, produced locally in China, won’t be impacted operationally although it will be by the financial strain of elevated tariffs.

Ford shipped around 5,500 Broncos, F-150s, Mustangs and Navigators to China during 2024, which was below its historical average of more than 20,000 units per annum.

The wider automotive industry is also feeling the impact of these tariffs. The Centre for Automotive Research estimates a 25 per cent levy on American automotive exports could result in up to US$108 billion in extra costs for carmakers by the end of this year.