Chips crisis mushrooms

Mercedes-Benz and Nissan are among the latest carmakers to ring alarm bells about the deepening semiconductor supply crunch.

It emphasises the importance of the increasing fallout from the row between China and the Netherlands over Dutch chipmaker Nexperia.

A trade and intellectual property tussle between the Dutch and Chinese governments is proving to be a major challenge for the automotive industry, which is already contending with US tariffs and curbs by China on rare-earth minerals.

China banned exports of Nexperia’s finished products from its plants after the Dutch government seized control over the chipmaker in September because of the possible transfer of technology to Wingtech, Nexperia’s Chinese parent company.

Ola Källenius, chief executive officer of Mercedes-Benz CEO, says his company is in discussions with other suppliers to replace Nexperia chips.

“We learned during the [last] chip crisis that if you rely too much on single sourcing, problems can arise,” he says. “Therefore, we have dual sourcing for many components.

“This case is different. The bottleneck is political, primarily between the US and China with Europe caught in the middle. The solution of this problem is, therefore, political.” He adds it’s hard to see how the situation will play out.

Nissan’s chief performance officer, Guillaume Cartier, says: “It’s a big issue. For the moment, we do not have full visibility.” He adds the brand is “okay” until the first week of November when it comes to chip supplies.

While it’s possible to have a grasp of the state of supply from its tier-one suppliers, it becomes more difficult further down the supply chain, says Cartier.

The situation is affecting car production globally. Honda has reduced or suspended production at several factories in North America, while Volkswagen says its production has been secure for October, but some short-term effects on its network remain possible.

In Brazil, some carmakers may have to halt operations within weeks if the crisis continues with the government there in contact with the Chinese authorities to find a solution.

Problem set to expand

The growing Nexperia semiconductor crisis has exposed how fragile the automotive industry’s microchip supply chains remain even after the 2020-23 shortage that hit global vehicle production.

“Our thinking had always been that manufacturers and suppliers should have learned from the last crisis,” says Sam Fiorani, vice-president of global vehicle forecasting at AutoForecast Solutions.

“In some cases, suppliers have stockpiled some parts in case of an issue like this. But it does not seem like they have completely learned that lesson and are not as prepared as they should be.”

Carmakers, suppliers and industry experts predict the number of affected companies will increase over the next few weeks, barring a quick resolution between the Chinese and Dutch governments.

The Netherlands took control of Nexperia on September 30. It feared the company’s former CEO was dismantling its European operations, with Reuters citing four sources familiar with the Dutch government’s thinking.

On October 4, the Chinese government blocked exports of Nexperia products from China. The company makes most of its chips in Europe, but packages about 70 per cent in China before shipping them worldwide.

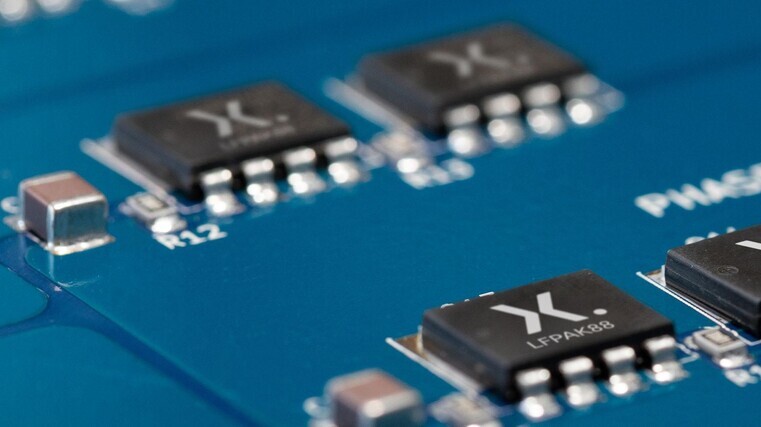

Nexperia produces basic, mature semiconductor technology, including diodes and transistors found in dozens of vehicle components such as door handles and motors for wiper blades.

The chips aren’t the costly, high-tech semiconductors that dominated past headlines, but are crucial for vehicle production. Each car contains between 300 and 600.

As the industry was reminded during the previous chip shortage, it takes just one missing part to mothball an entire production line. The previous semiconductor shortage, driven by a demand surge after 2020 Covid-19 shutdowns and a lack of widespread availability, cost the industry production of more than 17 million units globally from 2021-23, according to AutoForecast Solutions.

During the chip shortage, most attention centred on advanced microchips. But the car industry’s primary problem was an insufficient amount of legacy chips or those made using long-established processes.

It has been estimated 95 per cent of all semiconductors consumed by the industry are legacy chips, according to the Centre for Strategic and International Studies based in Washington DC.

Unlike those used in smartphones, for example, chips in vehicles need to be reliable and safe in extreme road and weather conditions and cannot falter, particularly if used in safety systems.

Now, years after the previous microchip shortage, the Nexperia crisis should serve as another wake-up call to the car industry that it needs to secure reliable supplies of legacy chips.

Lolly scramble for alternatives

Companies across the supply chain are busy trying to secure alternate chip sources to minimise potential effects on vehicle and parts production.

Volkswagen has found semiconductors from an alternate supplier that “could compensate for the loss of supply of Nexperia semiconductors”, says Christian Vollmer, the head of brand production.

Mary Barra, CEO of General Motors, has told investors the chip constraints “have the potential to impact production”. She adds: “We have teams working around the clock with our supply-chain partners to minimise possible disruptions.”

Robert Bosch, the world’s biggest parts maker, is using alternative sources and “optimising inventory levels” at its factories worldwide, according to a spokesman. “However, if there is no improvement of the export-control restrictions, temporary production adjustments in selected plants cannot be ruled out.”

Validation is one of the potential hold-ups companies may encounter as they secure alternative sources. If a tier-two supplier secures a new diode source, for example, not only would it need to approve it internally, but the tier-one parts maker and carmaker would need to do the same, which could take weeks or longer.

Capacity poses another challenge. While other companies worldwide make the same kinds of chips as Nexperia, it is unclear if there’s enough outstanding capacity to meet the automotive industry’s requirements as well as those of other sectors using these parts. And rising demand and competition will likely raise prices.

An immediate resolution hinges on an agreement between the Chinese and Dutch governments, and talks between the two are ongoing.

The Dutch believe they can negotiate a resolution with China that will restore the company to a unified Dutch-Chinese structure.

Wingtech, Nexperia’s parent, was placed on the US Commerce Department’s “entity list” by the Biden administration in December 2024, subjecting the company to licensing requirements.

Automotive News reports the Trump administration expanded the controls on September 29 to include subsidiaries of companies on that list, including Nexperia.