Autosure teams up with Marac

Autosure, which provides protection policies to car owners in New Zealand, is to receive an extra boost with its products to be sold through Marac’s network of more than 400 authorised motor-vehicle dealers.

A new strategic distribution agreement sees the relationship between the two companies being extended to include payment protection insurance (PPI) and guaranteed asset protection (GAP) products. This is in addition to Autosure already providing finance company Marac with mechanical breakdown insurance (MBI).

The partnership will increase Autosure’s distribution network by 20 per cent to more than 950 dealers across the country, and is expected to deliver an additional $2 million in annual premium revenue during the 2021 financial year.

While MBI remains Autosure’s most popular product, it is experiencing growing demand for its PPI and GAP offerings. These provide consumers with increased levels of protection with policy documentation written in a way to give customers greater clarity on what’s covered and to avoid surprises when they make claims.

$23m paid out in MBI claims over past year

Autosure is New Zealand’s biggest provider of MBI. With more than 31,000 claims and $23m paid out in the past 12 months, it “knows the value and peace of mind that these policies can provide to customers”.

Its policies are sold through approved car dealers nationwide. Extensive training is provided to traders, as well as ongoing support to ensure appropriate sales practices and that customers are fully informed.

James Searle, pictured, group general manager of Autosure, says: “Cars are complex mechanical and electrical machines that can and do break down, so MBI can be invaluable when it comes to the cost of repairs.

“Not many New Zealanders can afford a brand new car, and New Zealand has a high proportion of Japanese imports and an aging fleet of cars on its roads. This means breakdowns are likely to occur and the cost of repairs can quickly add up.

“The cost of an MBI depends on factors including make and model, and dealer promotions at the time. As an example, the approximate cost of a three-year MBI policy on a diesel double-cab utility is around $520 per year. That’s not bad when you consider it costs $5,300 to rebuild the engine following failure of the cambelt, as was recently covered under an Autosure policy.”

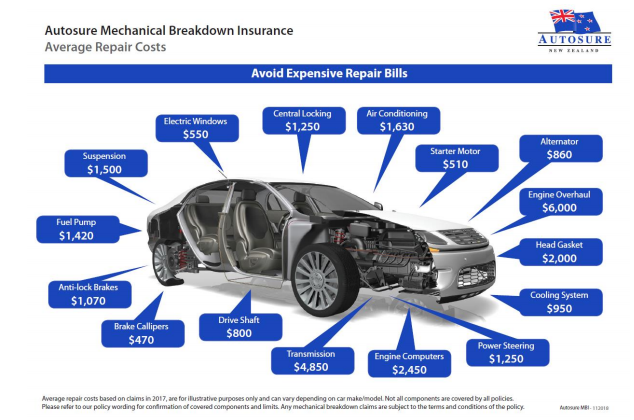

The $500,000 being paid out, on average, every week by Autosure includes repairs such as electric windows, which cost about $550 and central locking at $1,250, all the way up to transmission at $4,850 and an engine overhaul at $6,000.

MBI policies cover the cost of sudden or unforeseen breakdown and repairs and, like the majority of insurance policies, exclude pre-existing faults. Extra benefits can be added onto policies, such as AA breakdown service, towing, a rental car and accommodation.