In depth: the car chip crisis

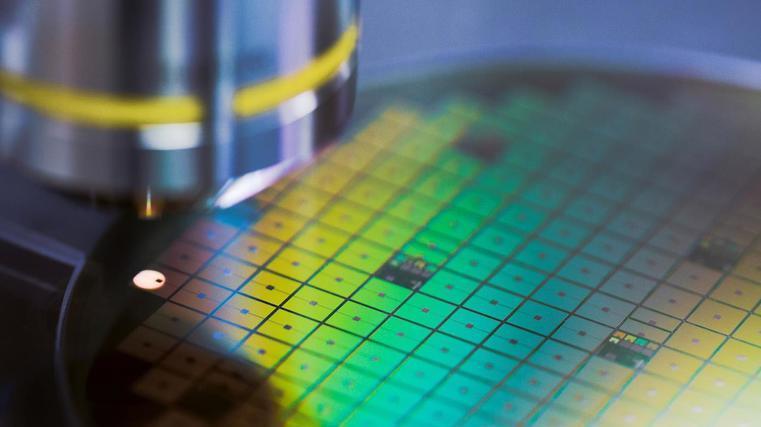

Since the first quarter of 2021, the global semi-conductor shortage has wreaked havoc on assembly lines around the world.

It has slowed the production of everything from smartphones to home appliances and, more significantly, driver-assistance systems. Disruptions in the car industry have come to the fore from the very beginning of the coronavirus pandemic.

Automotive sales have plummeted significantly worldwide – 80 per cent down in Europe, nearly 70 per cent in China and 50 per cent in the US.

The semi-conductor shortage not only shocks the car sector, but also other industries struggling to secure chips. Recently, the repercussions for automotive have been even worse. A significant shortage of semi-conductors is forcing OEMs to close production lines or remove some popular features, such as heated seats, from their offerings.

As OEMs and tier-one suppliers cannot guarantee sufficient quantities of chips and delay vehicle production, revenues are nosediving. The chip crisis also highlights the fragility of supply chains that depend on Asia as a major hub of semi-conductor manufacturing.

The growing crisis

The current chip shortage primarily boils down to strong demand and limited supply that’s the result of the convergence of several unprecedented events, such as growing needs, geopolitical tensions and the pandemic.

China-based AutoChips, founded in 2013, is a wholly owned subsidiary of NavInfo Co Ltd, which researches and develops automotive electronics.

Nicle Ma, the vice-president of the AutoChips, has revealed to EqualOcean International, an information service provider and investment research company, that the chip shortage has existed for years.

The reasons behind are complicated, including Covid-19, political issues around the world, natural disasters, China’s automotive revolution, surging price of raw materials and inflation.

Affected by pandemic

During the first half of 2020, the automotive industry underwent a substantial drop in demand. Supply-chain issues were widespread and prevalent.

Due to the shift towards remote work and greater need for connectivity, consumer demand for chips increased sharply for personal computers, servers and equipment for wired communications, all of which are highly reliant on semi-conductors. In this context, the car industry dramatically reduced chip orders and shifted production to meet the demand from other sectors.

Due to Covid-19 lockdowns in the second half of 2020, many car manufacturers closed partial production lines affected by semi-conductor supply issues. Affected by coronavirus and trade frictions, the long-term supply and demand balance between chip suppliers and car makers along the industrial chain in the automotive industry has been broken.

The pandemic has been regarded as a short-term factor breaking the supply and demand balance of automotive chips. The fundamental factor is that the car industry is transforming toward automation and electric cars. This major shift would require more chips, exerting additional pressure on the already stretched industry.

Lack of capacity

China’s automotive revolution refers to the country’s ambitious plan to revolutionise its car industry. It involves excluding conventional cars and only manufacturing energy vehicles. There are four indicators which are autonomous, connected, electrified and shared mobility (ACES) invoked by China Passenger Car Association to express the changes.

In May 2022, the ACES index was 73. It increased by 6.8 when compared with the previous year’s corresponding period. This indicated EV market penetration is increasing. Technically, a conventional vehicle will use around 500 chips, but an EV uses 1,000-2,000 chips. So, with the development of the EV market, the supply of chips won’t be enough.

Geopolitical tensions

As semi-conductors play an increasingly important role in the global economy, the competition for technology supremacy between China and the US has intensified.

The two countries are interdependent to sustain the supply chain. In comparison with China, the US currently has an advantage in manufacturing capacity, particularly intellectual property, chip design and non-wafer materials.

On the other hand, China harbours the most important suppliers of raw materials needed for manufacturing, such as silicon. In terms of contract manufacturing, both the US and China depend heavily on Taiwan, South Korea and Japan.

The globalisation of the automotive industry chain has resulted in improved efficiency and reduced costs. The production of automotive chip electronic components involves a series of processes that are usually completed around the world.

Due to this regionally fragmented nature of chip production, companies from third countries are pulled into the geopolitical competition, which may further destabilise fragile supply chains.

Moreover, geopolitical tensions have been exacerbated by the pandemic, which have had a massive impact on the global supply chain of the semi-conductor industry.

Limited inventory

The automotive sector has unique characteristics that could further exacerbate the shortage crisis. For example, many OEMs and tier-one suppliers follow a “just in time" manufacturing strategy.

Such practices are widely leveraged in the automotive supply chain, which can optimise inventory costs and enhance productivity. The reduction of inventory is financially beneficial in normal times.

However, in the event of an unexpected shortage, this practice has caused immediate disruption of the entire supply chain. Since many players did not expect chip storage in 2020 and 2021, they likely had limited stock availability.

Tackling the crisis

Due to the complexity of semi-conductor manufacturing and increasingly sophisticated chip design, creating stronger technology roadmaps is of great significance to allow tier-one suppliers to increase transparency and steer product development more strategically.

The current automotive chip crisis also highlights the need to strengthen R&D on core technologies, such as the manufacturing of chips and packaging, to break through the technical bottleneck. Enhancing R&D capacity would solve bottlenecks in local markets and global markets. It will also improve supply chain resilience and facilitate stronger brand positioning.

In addition, manufacturers can leverage data technologies and make sense of the economic indicators as economic analytics will be an important weapon in this crisis.

Opportunity for China

The Chinese market share of vehicle regulation chips for its domestic manufacturers has been low. Domestic semi-conductor manufacturers demonstrate their own strengths and opportunities, accompanied by three factors – chip shortage, localisation substitution and the popularity of new energy-intelligent networked vehicles. This is mainly manifested by:

• Surging demand and growth spurt in the market. Previously, the demand for chips in traditional-fuel vehicles was far less than the current demand for smart networked EVs.

• Domestic semi-conductor makers have the chance to enter the automotive supply-chain system. They can communicate with car manufacturers before being occupied by international manufacturers, which is rare.

• Accumulated human talents and capital directly promote the rapid development of domestic chip manufacturers. The most important thing for domestic chip makers is to cultivate internal strengths and improve products. The fundamental way is to make chips comparable to international manufacturers.

Technological limitations and lack of talent are the main obstacles for Chinese semi-conductors to lead the global market. For automotive chip R&D, it takes a long time to design and test, and this cost is massive. Also, to design chips, wafer fabs, testing, and talent in the chip supply chain are needed.

Summing up

The chip shortage is disrupting the automotive industry and related businesses across the value chain as OEMs and their suppliers. As a result, the current semi-conductor and supply-chain disruption have a long-term and lasting impact on price and availability. It is likely the situation will persist until 2023, so decisive actions must be taken.

OEMs and tier-one suppliers could experiment and investigate innovative solutions, ensuring greater transparency and co-operation. Innovation and supply-chain management are of great significance to navigate a persistent and widespread chip shortage.

For example, increasing investments in innovative technologies will develop leading-edge chips for autonomous cars, the internet of things, artificial intelligence and other technology-related areas with exponential growth.